The banking industry is undergoing a profound transformation, driven by rapid advancements in technology. From digital-only banks to blockchain-powered transactions, the financial sector is evolving to meet the demands of an increasingly digital world. In this blog, we’ll explore how technology is reshaping the banking landscape, its implications for consumers, and the opportunities it presents for innovation.

1. The Rise of Digital-Only Banks

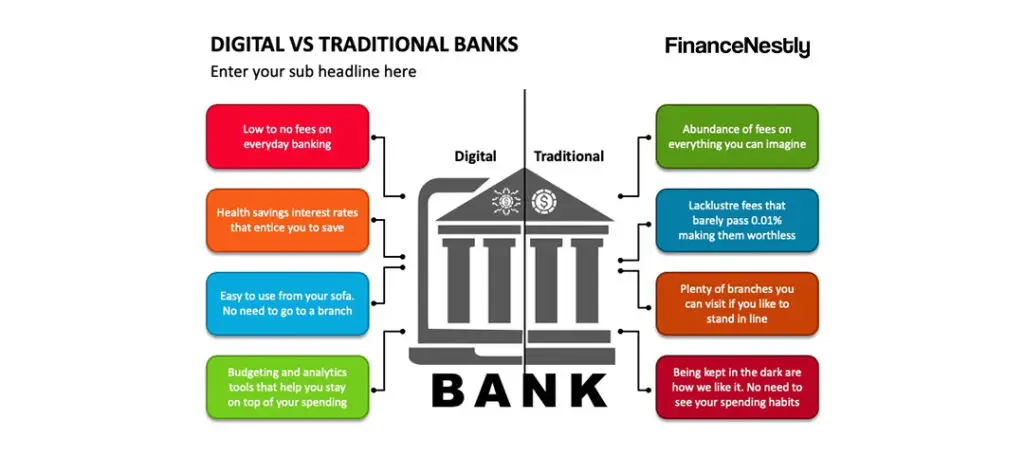

Digital-only banks, also known as “neobanks,” have become a significant force in the financial sector. These institutions operate entirely online, offering services such as savings accounts, loans, and investments without the need for physical branches.

Neobanks leverage advanced technologies like artificial intelligence and big data to offer personalized financial services. For example, AI algorithms analyze customer behavior to suggest tailored savings plans or investment opportunities. This level of customization, coupled with lower operational costs, makes digital banks an attractive alternative to traditional institutions.

2. Blockchain: Revolutionizing Transactions and Security

Blockchain technology is playing a pivotal role in redefining how financial transactions are conducted. By enabling secure, transparent, and decentralized processes, blockchain reduces the need for intermediaries, speeding up transactions and cutting costs.

Cryptocurrencies, built on blockchain, are becoming more widely accepted, with some banks integrating crypto services into their offerings. Beyond currencies, blockchain is also being used for secure document verification and fraud prevention.

For a deeper dive into blockchain’s role in banking, read this comprehensive guide on blockchain in finance.

3. The Growth of Fintech and Super Apps

Fintech companies have emerged as disruptors in the financial world, offering innovative solutions that blend technology and finance. From mobile payment platforms to investment management apps, fintech is making banking services more accessible and user-friendly.

Super apps—platforms combining multiple financial services in one place—are gaining traction. These apps integrate banking, payments, investments, and even e-commerce, providing users with a seamless financial experience. The convenience and efficiency of super apps make them a key player in the future of banking.

4. AI and Data Analytics: Enhancing Customer Experience

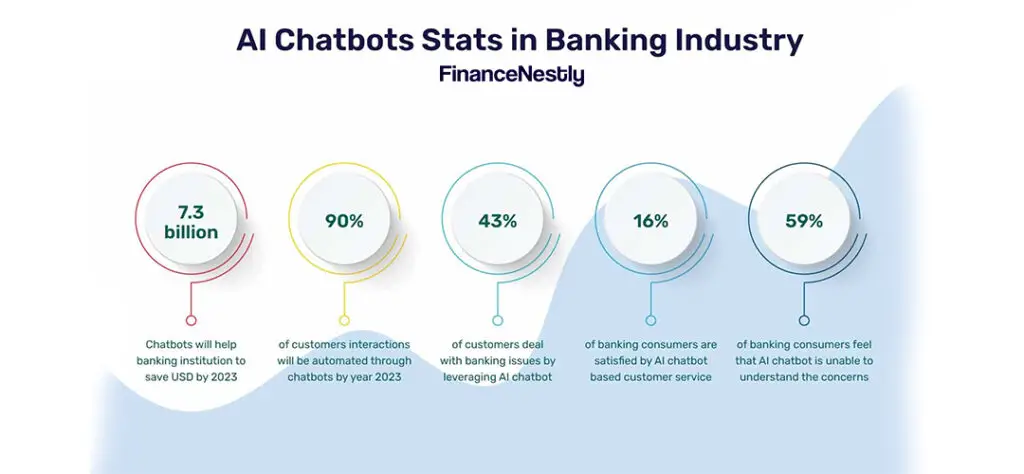

Artificial intelligence and data analytics are transforming customer interactions in banking. Chatbots powered by AI handle routine customer inquiries, providing instant responses and freeing up human agents for complex issues.

Additionally, data analytics allows banks to understand customer behavior better, enabling them to offer personalized services and products. Predictive analytics can identify at-risk accounts or opportunities for cross-selling, driving better business outcomes for banks.

5. Challenges and Opportunities in the Tech-Driven Banking Era

While technology offers numerous advantages, it also presents challenges. Cybersecurity threats are a growing concern, as increased digitalization creates more opportunities for breaches. Banks must invest in robust security measures to protect sensitive customer data.

Another challenge is regulatory compliance. As technologies like AI and blockchain evolve, regulators are working to create frameworks that ensure fairness and transparency. For banks, staying ahead of these regulatory changes will be crucial for success.

Despite these challenges, the opportunities for innovation and customer-centric services far outweigh the risks.

6. The Future of Banking: What Lies Ahead

The future of banking is undoubtedly digital. As technologies like blockchain, AI, and IoT mature, banks will continue to evolve, offering smarter, faster, and more secure financial solutions. Collaboration between traditional banks and fintech companies will likely shape the next phase of innovation, creating a more inclusive and efficient financial ecosystem.

For consumers, this future promises greater convenience, personalized experiences, and access to financial services anytime, anywhere.

Conclusion

Technology is reshaping the banking landscape at an unprecedented pace. From neobanks and blockchain to AI-driven insights, the future of banking is one of innovation and transformation. While challenges remain, the potential for creating a smarter and more inclusive financial system is within reach, driven by the power of technology.