Factor investing has emerged as a transformative strategy in portfolio management, shifting the focus away from traditional asset allocation methods to a more systematic, data-driven approach. This investment style relies on specific, identifiable characteristics, or “factors,” that drive the performance of various assets. While it is not entirely new, its adoption has surged in recent years, as investors look for ways to maximize returns while minimizing risks. In this post, we’ll explore what factor investing is, why it’s becoming more popular, and how it’s reshaping the investment landscape.

What is Factor Investing?

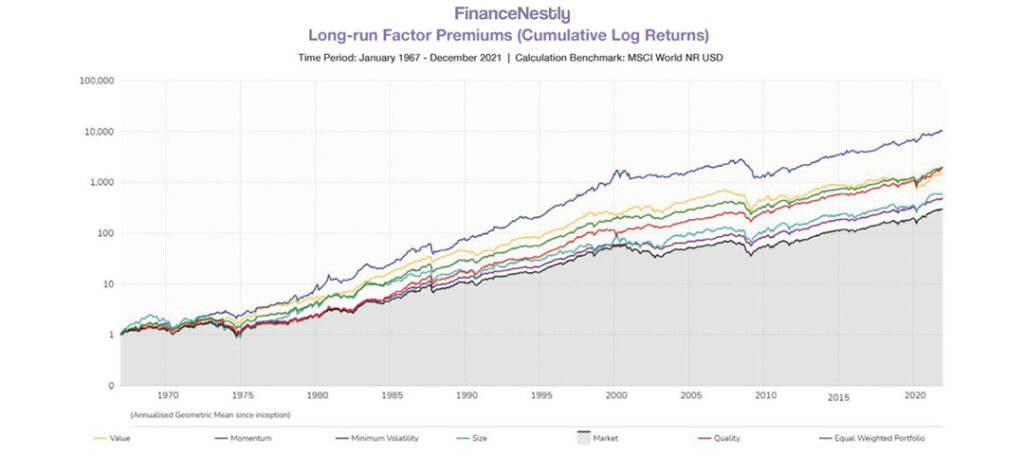

Factor investing is a systematic investment strategy that targets certain characteristics of stocks, bonds, or other assets that have historically been associated with superior returns. These factors can be broadly categorized into style factors, such as value, momentum, quality, and volatility, as well as macroeconomic factors like size and liquidity.

- Value Factor: This focuses on investing in assets that appear undervalued relative to their fundamentals. Investors using this factor look for stocks with low price-to-earnings (P/E) ratios, high dividend yields, or other indicators of being undervalued.

- Momentum Factor: This strategy revolves around buying assets that have shown consistent performance or upward trends in price over time, under the assumption that they will continue to perform well in the near future.

- Quality Factor: Quality investing targets companies with strong fundamentals, such as high return on equity (ROE), low debt-to-equity ratios, and stable earnings growth.

- Volatility Factor: Low-volatility investing targets assets that are less volatile than the broader market, aiming to reduce risk while providing consistent returns.

Factor investing combines these various factors to create a portfolio that aligns with an investor’s risk tolerance and long-term financial goals. By focusing on specific drivers of asset performance, investors can potentially achieve better risk-adjusted returns.

Why is Factor Investing Gaining Popularity?

Factor investing has gained significant traction in recent years for several reasons. First, it offers investors a more scientific, data-driven way to manage risk and return compared to traditional investment methods. In a market that is increasingly driven by algorithms and big data, this systematic approach allows investors to base their decisions on measurable, quantifiable factors rather than subjective analysis.

Another reason for its rise is the growth of exchange-traded funds (ETFs) and mutual funds that target specific factors. These funds have made it easier for individual investors to implement factor-based strategies without the need for extensive research or a deep understanding of financial markets. This democratization of factor investing has led to greater accessibility and adoption, particularly among retail investors.

Additionally, factor investing is seen as a way to potentially outperform traditional passive investing strategies, such as those that track major indices like the S&P 500. By focusing on factors that have historically delivered excess returns, investors hope to gain an edge over the broader market.

For more insights into how factor investing is challenging traditional investment strategies, check out this guide on factor investing.

How Factor Investing is Reshaping Portfolio Management

In the past, portfolio management largely revolved around asset allocation based on the capital market assumptions, i.e., the expected returns of different asset classes. Investors would divide their portfolios between stocks, bonds, and cash, based on their risk tolerance and time horizon. However, factor investing is changing this approach by shifting the focus to specific drivers of return, such as value or quality.

Rather than relying solely on traditional diversification (mixing asset classes), factor investing advocates suggest that diversifying across factors can provide more stability and higher returns. This means that instead of having a portfolio that is just split between equities and bonds, a factor-based portfolio might contain stocks selected based on their value, quality, momentum, or low volatility characteristics.

Furthermore, factor investing is more flexible and dynamic than traditional methods. Investors can adjust their portfolios over time as different factors become more or less effective, based on current economic conditions and market trends.

The Risks of Factor Investing

Despite its potential benefits, factor investing is not without risks. One of the main challenges is that the effectiveness of certain factors can vary over time. For instance, the value factor may perform exceptionally well during market downturns but could underperform during periods of strong growth. Momentum, on the other hand, can be volatile and susceptible to sudden market shifts.

Another risk is that factors can become overcrowded. As more investors flock to factor-based strategies, the returns generated by certain factors may diminish. This is why it’s important to monitor and adjust factor portfolios regularly to ensure they align with current market conditions.

The Future of Factor Investing

Factor investing is expected to continue evolving in the coming years, with new factors and variations emerging as the financial landscape changes. Some experts predict that factor investing could be further enhanced by artificial intelligence (AI) and machine learning, which would allow for better identification of factors and more precise predictions of their performance.

The ongoing rise of sustainable investing, for instance, has led to the emergence of new factors related to environmental, social, and governance (ESG) criteria. These ESG factors are being integrated into traditional factor investing models, allowing for a more holistic approach to portfolio management.

As technology continues to advance and more data becomes available, factor investing is likely to become even more sophisticated, helping investors make better decisions and create more resilient portfolios.

Conclusion

Factor investing represents a significant shift in how investors approach portfolio management, offering a systematic, data-driven method for identifying high-potential investment opportunities. With the ability to target specific drivers of returns such as value, momentum, and quality, factor investing allows for greater flexibility and potentially higher returns than traditional asset allocation strategies. However, it’s important to recognize the risks involved, as factors may underperform in certain market conditions. By staying informed about emerging trends and adjusting your factor-based portfolio accordingly, you can position yourself for success in the evolving investment landscape of 2024.