Cryptocurrency has become a global phenomenon, capturing the attention of both seasoned and novice investors. However, venturing into this dynamic market requires a clear understanding of its unique challenges and opportunities. This guide will walk you through the essential steps to start investing in cryptocurrencies, offering actionable insights to help you navigate this exciting financial frontier confidently.

1. Understand the Basics of Cryptocurrency

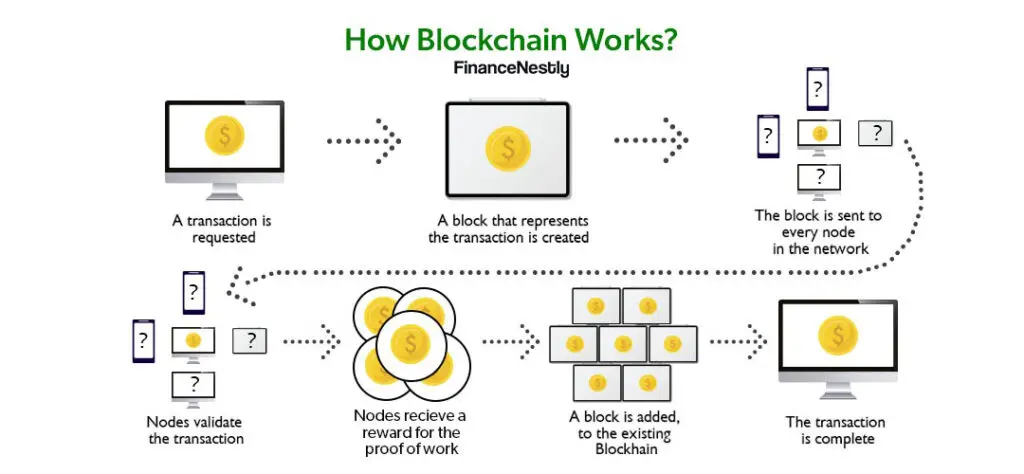

Before diving into investments, it’s crucial to understand what cryptocurrency is and how it works. Cryptocurrencies are digital or virtual assets that use blockchain technology for secure, decentralized transactions. Popular examples include Bitcoin, Ethereum, and Binance Coin.

Take time to familiarize yourself with the following concepts:

- Blockchain Technology: The underlying system that powers cryptocurrencies, ensuring transparency and security.

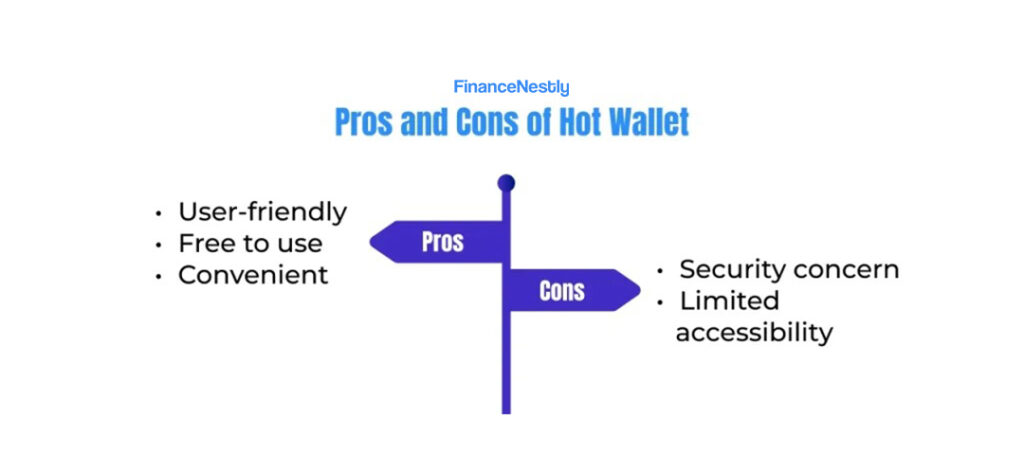

- Wallets: Digital tools that store your crypto assets, with options including hot wallets (online) and cold wallets (offline).

- Decentralization: The absence of central authorities, making cryptocurrencies resistant to government control or interference.

To build foundational knowledge, explore reputable cryptocurrency educational platforms.

2. Choose a Reliable Exchange Platform

Cryptocurrency exchanges are platforms where you can buy, sell, or trade digital currencies. Popular exchanges like Coinbase, Binance, and Kraken are user-friendly and provide secure environments for transactions. When selecting an exchange, consider factors such as:

- Security: Ensure the platform offers two-factor authentication (2FA) and has a history of protecting user funds.

- Fees: Review transaction, withdrawal, and conversion fees, as these can impact your returns.

- Supported Coins: Choose an exchange that supports the cryptocurrencies you’re interested in.

Many platforms offer beginner guides and demo accounts to familiarize yourself with the trading process before investing real money.

3. Start Small and Diversify

Cryptocurrency investments can be volatile, with prices fluctuating dramatically in short periods. As a beginner:

- Start with a small investment that you can afford to lose.

- Avoid putting all your funds into a single cryptocurrency. Diversifying across different assets can help mitigate risks.

For example, pairing stablecoins like USDT with riskier assets like Bitcoin or Ethereum can balance your portfolio.

4. Learn About Risk Management

Managing risks is an essential part of cryptocurrency investing. Since the market operates 24/7 and is highly unpredictable, adopt strategies to safeguard your investments:

- Set Stop-Loss Orders: Automatically sell assets if their value drops to a predetermined level.

- Avoid Emotional Decisions: Base your trades on research, not fear or hype.

- Keep Funds Secure: Store significant holdings in cold wallets to minimize hacking risks.

You can find comprehensive crypto trading strategies on leading financial websites.

5. Stay Updated and Continuously Learn

The cryptocurrency landscape is evolving rapidly, with new coins, regulations, and technologies emerging frequently. To stay informed:

- Follow reputable news outlets like Coindesk or CoinTelegraph.

- Join online communities and forums such as Reddit’s r/CryptoCurrency or Telegram groups.

- Regularly review updates from your chosen exchange or wallet provider.

Continuous education will help you adapt to market trends and make informed decisions.

6. Plan for Taxes and Legal Compliance

Cryptocurrency investments often have tax implications. Many countries treat crypto as taxable property, requiring you to report gains and losses.

- Consult a tax advisor or use software like CoinTracker to stay compliant.

- Understand the legal framework for crypto in your country to avoid unexpected penalties.

Conclusion

Investing in cryptocurrency can be both rewarding and challenging. By understanding the basics, choosing reliable platforms, managing risks, and staying informed, you can set yourself up for success in this rapidly growing market. Remember, patience and caution are key when navigating the unpredictable world of digital assets.