Blockchain technology has emerged as a transformative force, disrupting traditional systems across industries. Among its most impactful applications is the banking sector, where blockchain is rewriting the rules of security, efficiency, and accessibility. This blog dives deep into how blockchain is revolutionizing the financial world and paving the way for a more transparent and robust banking infrastructure.

1. The Current Challenges in Banking

Despite its critical role in the global economy, the traditional banking sector faces numerous challenges.

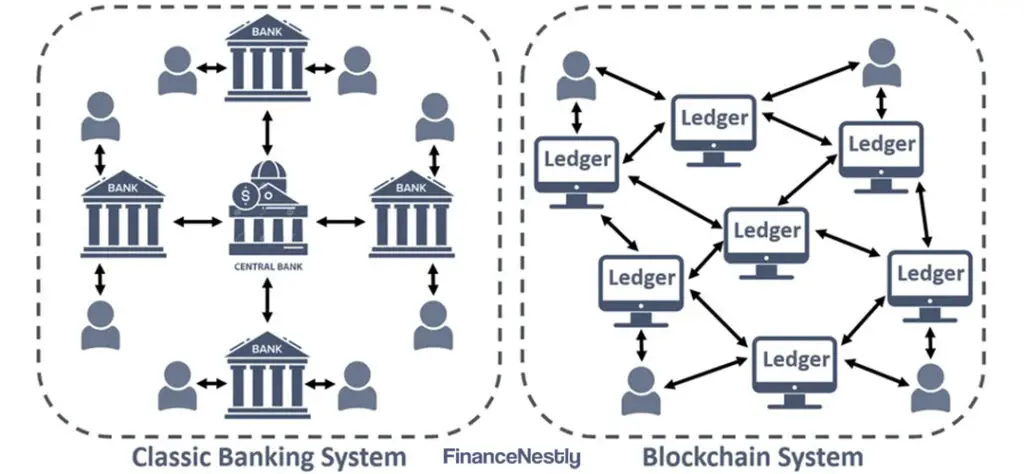

- Lack of Transparency: Centralized banking systems operate in silos, often limiting customer visibility into processes like transactions and fees.

- High Costs: Intermediaries and outdated systems drive up costs for cross-border payments and other services.

- Security Risks: The rise in cyberattacks and data breaches threatens customer trust and financial stability.

Blockchain technology promises to address these persistent issues with its decentralized and secure architecture.

2. How Blockchain is Transforming Transactions

One of the most significant impacts of blockchain is on banking transactions.

- Speed and Efficiency: Blockchain eliminates intermediaries, allowing transactions to be completed in seconds rather than days.

- Lower Costs: By bypassing traditional clearinghouses, blockchain reduces fees for cross-border payments.

- Transparency: Every transaction on a blockchain is recorded in a distributed ledger, ensuring accountability.

3. Enhanced Security Through Decentralization

Security is paramount in banking, and blockchain offers a revolutionary approach.

- Immutable Records: Transactions recorded on a blockchain cannot be altered, reducing fraud.

- Cryptographic Protection: Advanced cryptography ensures that sensitive data is secure.

- Decentralization: Unlike traditional systems, blockchain has no single point of failure, making it more resistant to cyberattacks.

Major banks are already adopting blockchain for secure record-keeping.

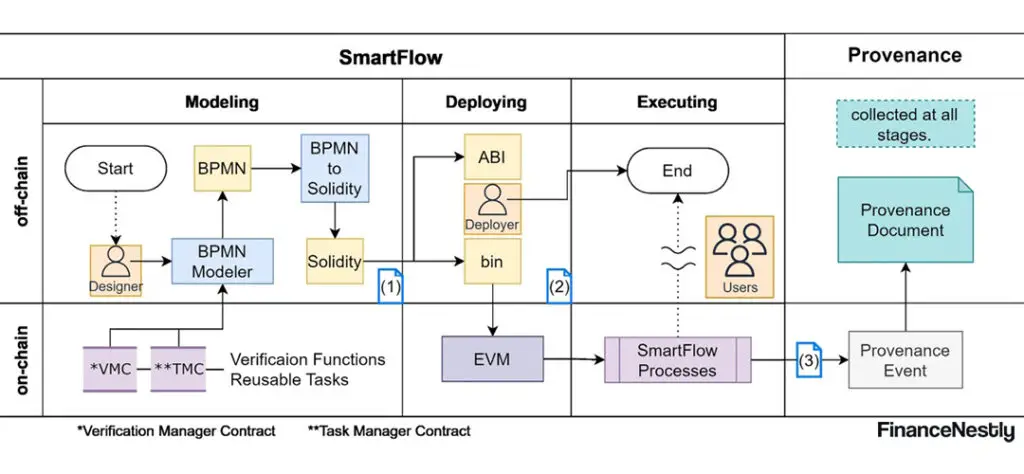

4. Smart Contracts: Automating Banking Operations

Smart contracts are self-executing agreements coded onto blockchains. These are revolutionizing banking operations such as loan disbursements, insurance claims, and more.

- Automated Execution: Smart contracts execute transactions when predefined conditions are met, reducing delays.

- Error Reduction: By eliminating manual processes, smart contracts minimize errors.

- Cost Savings: Automation significantly reduces operational costs.

This technology is already being utilized in peer-to-peer lending platforms, enabling more transparent and efficient processes.

5. Blockchain’s Role in Financial Inclusion

In addition to improving existing banking systems, blockchain is helping to include unbanked populations in the financial ecosystem.

- Access to Services: Blockchain-based platforms enable banking services without the need for traditional infrastructure.

- Lower Entry Barriers: With blockchain, even small-scale transactions are economically viable.

- Cross-Border Reach: Blockchain allows individuals in remote areas to access international markets.

Projects like Stellar and Ripple are spearheading this movement, connecting underserved regions with global financial networks.

6. The Future of Blockchain in Banking

Blockchain’s adoption in banking is still in its early stages, but the future looks promising.

- Central Bank Digital Currencies (CBDCs): Several countries are exploring blockchain-based digital currencies.

- Decentralized Finance (DeFi): DeFi is creating an entirely new ecosystem for banking without intermediaries.

- Green Banking: Blockchain enables tracking and incentivizing environmentally friendly banking practices.

As these innovations gain momentum, blockchain will continue to reshape banking into a more efficient, secure, and inclusive system.

Conclusion

Blockchain technology is revolutionizing the banking sector by addressing its most pressing challenges and unlocking unprecedented opportunities. From speeding up transactions to enhancing security and driving financial inclusion, blockchain is not just a trend but a transformative force for the future of finance.