Artificial intelligence (AI) is transforming the financial trading landscape, introducing innovative ways to analyze markets, execute trades, and manage risks. In this blog post, we’ll explore how AI is reshaping trading strategies and what this means for traders, investors, and the broader financial ecosystem.

1. Understanding the Role of AI in Financial Markets

AI has brought unprecedented capabilities to financial markets by processing vast amounts of data in real time. Traditional trading strategies often rely on human analysis and predefined algorithms. However, AI-powered tools, such as machine learning models and natural language processing, enable traders to detect patterns and insights that would otherwise go unnoticed.

For example, machine learning algorithms can analyze historical price data to predict future trends, while sentiment analysis tools can gauge market mood from news articles and social media posts. These AI-driven methods allow traders to make more informed decisions and stay ahead of market movements.

2. The Shift Toward Algorithmic Trading

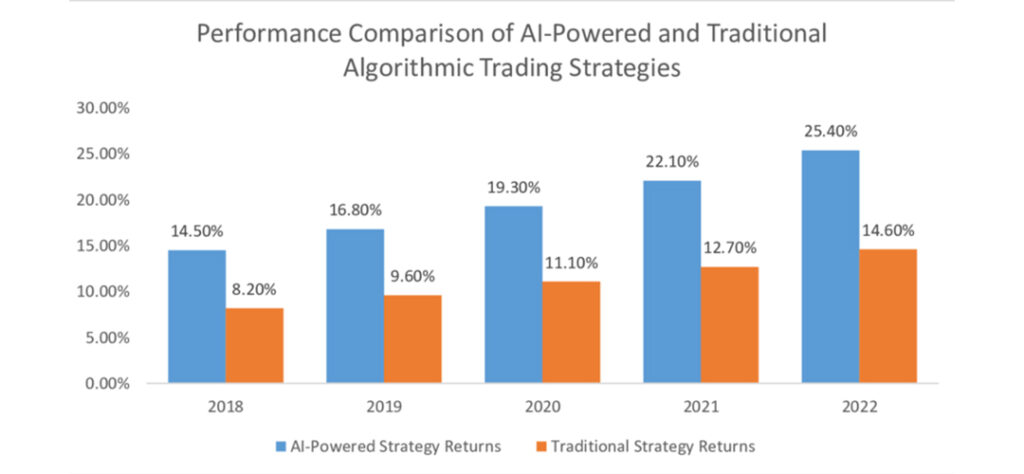

AI is a cornerstone of algorithmic trading, where computer programs execute trades based on pre-set rules and strategies. With AI, these algorithms have become smarter, adapting to changing market conditions in real time.

One significant advantage is the ability to minimize human bias and emotion in trading decisions. AI-powered systems also excel in high-frequency trading (HFT), where speed is critical. These systems can identify micro-opportunities and execute trades within milliseconds, a capability beyond human reach.

For further reading on high-frequency trading, check out this comprehensive guide on algorithmic trading.

3. Risk Management and Fraud Detection

In addition to identifying opportunities, AI plays a critical role in managing risks and detecting fraudulent activities. Advanced AI systems can monitor market conditions and alert traders to potential risks, such as sudden price swings or liquidity shortages.

Similarly, machine learning algorithms are increasingly used to combat financial fraud. By analyzing transactional patterns, AI can identify suspicious activities and prevent significant financial losses. This dual functionality of opportunity detection and risk mitigation makes AI an indispensable tool for modern trading.

4. The Ethical and Regulatory Challenges of AI in Trading

Despite its many benefits, AI in financial trading also raises ethical and regulatory concerns. Critics argue that reliance on AI could exacerbate market volatility or lead to unequal advantages for firms with superior technology. Regulators are also grappling with how to oversee AI-driven trading to ensure fairness and prevent manipulation.

To dive deeper into regulatory challenges, visit this article on financial regulations and AI.

Balancing innovation with accountability will be key to the sustainable integration of AI in financial markets.

5. Future Trends: AI’s Role in Shaping Financial Strategies

Looking ahead, AI is expected to play an even greater role in financial trading strategies. Emerging technologies like quantum computing could amplify AI’s capabilities, making predictive models even more accurate. Additionally, the integration of AI with blockchain technology promises to enhance transparency and efficiency in trading operations.

As AI evolves, traders and institutions must remain agile, continuously adapting to harness its full potential while navigating the challenges it presents.

Conclusion

Artificial intelligence is revolutionizing financial trading, offering unparalleled insights, efficiency, and risk management capabilities. While challenges remain, its transformative impact on trading strategies is undeniable, marking a new era for global markets.