Car insurance is a vital aspect of responsible driving, offering protection in case of accidents, theft, or other unexpected events. With numerous types of coverage available, understanding what each one offers is essential for selecting the right insurance policy for your needs. This guide will break down the key elements of car insurance coverage, explain the different options available, and help you make an informed decision when choosing the best policy for your vehicle.

1. Types of Car Insurance Coverage

When it comes to car insurance, there are several types of coverage to consider, each providing different forms of protection. The primary options include liability insurance, collision insurance, and comprehensive coverage, among others.

Liability Insurance

Liability insurance is required in most states and covers damage you cause to others in an accident. It includes two main components: bodily injury liability and property damage liability. Bodily injury liability pays for medical expenses, lost wages, and legal fees resulting from injuries you cause to others in an accident. Property damage liability, on the other hand, helps cover repairs or replacement of another person’s vehicle or property that you damage during a collision.

Collision Insurance

Collision insurance is designed to pay for repairs to your own vehicle after an accident, regardless of who was at fault. This type of coverage is especially important for those who have a newer or more valuable car. If your car is damaged in a crash, collision insurance can help cover the cost of repairs or replacement, less any deductible.

Comprehensive Coverage

Comprehensive insurance, also known as “other than collision” coverage, provides protection against non-collision-related incidents, such as theft, vandalism, or weather-related damage (like hailstorms or flooding). This coverage can help repair or replace your vehicle if it’s damaged by something other than a crash. Although it’s not mandatory, comprehensive coverage is highly recommended for those living in areas with a high risk of natural disasters or theft.

Add-Ons and Optional Coverage

Beyond the basic coverage options, there are several add-ons and optional coverages you can consider. These include rental car coverage, roadside assistance, and gap insurance. Rental car coverage pays for a rental car if your vehicle is being repaired due to an accident, while roadside assistance provides services like tire changes, lockout help, and towing. Gap insurance is particularly useful if you owe more on your car loan than your car is worth, as it covers the difference between the loan balance and the car’s current value.

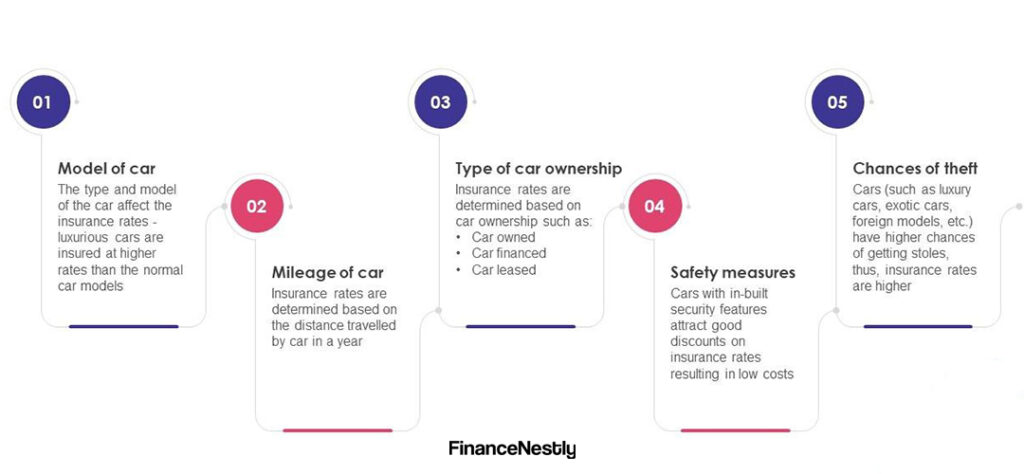

2. Factors Affecting Car Insurance Rates

Several factors influence how much you’ll pay for car insurance. Understanding these factors can help you save money by identifying areas where you can make adjustments. Here are some of the key elements that affect car insurance premiums:

Driving Record

Your driving history is one of the most significant factors in determining your car insurance premium. Drivers with a clean record, free from accidents and traffic violations, typically pay lower rates. On the other hand, if you have a history of accidents or speeding tickets, expect higher premiums.

Age and Gender

Younger drivers, especially those under 25, tend to pay more for car insurance due to their higher risk of accidents. Additionally, men typically pay higher rates than women, although this difference has been narrowing in recent years. However, age and gender are just part of the equation.

Vehicle Type

The make and model of your car also play a role in determining your insurance rate. Cars with higher safety ratings, better anti-theft features, and a lower likelihood of being involved in accidents often cost less to insure. Conversely, high-performance cars or luxury vehicles typically come with higher premiums due to their repair costs and increased risk of theft.

Location

Where you live can significantly impact your car insurance premium. Urban areas tend to have higher rates of accidents, theft, and vandalism, which leads to higher premiums. If you live in a rural area, your rates may be lower due to fewer incidents. Additionally, your state’s insurance laws and regulations can also affect the cost of your policy.

3. How to Save on Car Insurance

While car insurance is necessary, there are several ways to lower your premiums without compromising your coverage. Here are a few tips to help you save on car insurance:

Shop Around

It’s essential to compare quotes from different insurance providers to find the best deal. Insurance rates can vary significantly between companies, so shopping around could help you secure a more affordable policy. Be sure to compare the same coverage limits and deductibles when obtaining quotes.

Increase Your Deductible

Increasing your deductible—the amount you pay out of pocket before insurance kicks in—can lower your premium. However, this option comes with a trade-off, as you’ll have to pay more in the event of a claim. It’s essential to choose a deductible you can comfortably afford.

Bundle Policies

Many insurers offer discounts if you bundle your car insurance with other policies, such as homeowners or renters insurance. This can be an effective way to save on your overall insurance costs.

Maintain a Good Credit Score

In many states, insurers use your credit score to help determine your insurance premiums. Maintaining a good credit score can lead to lower rates. Be sure to check your credit regularly and take steps to improve it if necessary.

Take Advantage of Discounts

Many insurance companies offer discounts for various reasons. For example, you may qualify for a discount if you have a safe driving record, take a defensive driving course, or install anti-theft devices in your car. Be sure to ask your insurer about available discounts to ensure you’re getting the best possible rate.

Conclusion

Understanding the different types of car insurance coverage, the factors affecting your premiums, and the ways to save money can help you make the right decisions when selecting a policy. It’s essential to ensure that you have the coverage that suits your needs while keeping your premiums affordable. Don’t hesitate to shop around, compare policies, and ask questions to ensure you’re getting the best value for your money.