Introduction: Smart Strategies to Save More

Reducing your tax bill is not just about filing on time—it’s about making strategic decisions throughout the year. By taking advantage of tax deductions, credits, and smart financial planning, you can significantly lower your taxable income and keep more money in your pocket.

In this guide, we’ll explore the most effective ways to reduce your tax bill while staying compliant with tax laws.

Maximize Retirement Contributions

Why It Matters

Contributions to retirement accounts like 401(k)s and IRAs not only prepare you for the future but also reduce your taxable income.

Key Benefits

- Traditional 401(k) contributions are tax-deferred, meaning they reduce your taxable income in the year you contribute.

- Roth IRA contributions don’t offer upfront tax savings but provide tax-free withdrawals in retirement.

How to Take Action

- Contribute the maximum allowable amount. For 2024, this is $22,500 for 401(k)s and $6,500 for IRAs (with a $7,500 catch-up contribution for those 50 and older).

- Consider employer matching contributions for additional savings.

Take Advantage of Tax Credits

What Are Tax Credits?

Unlike deductions, which reduce your taxable income, tax credits directly reduce the amount of tax you owe.

Popular Tax Credits for 2024

- Child Tax Credit: Provides up to $2,000 per qualifying child.

- Earned Income Tax Credit (EITC): Benefits low- to moderate-income earners, with amounts based on income and family size.

- Energy-Efficient Home Improvement Credit: Offers savings for installing solar panels or upgrading insulation.

How to Qualify

Ensure you meet income thresholds and retain documentation to substantiate your eligibility.

Itemize Your Deductions

Standard vs. Itemized Deductions

While the standard deduction is a straightforward option, itemizing can save more if you have significant deductible expenses.

Common Itemized Deductions

- Mortgage interest payments

- Medical expenses exceeding 7.5% of your AGI

- Charitable contributions

How to Decide

Compare your eligible itemized deductions to the standard deduction ($13,850 for single filers and $27,700 for married filing jointly in 2024) to see which provides greater savings.

Utilize Health Savings Accounts (HSAs)

What Are HSAs?

HSAs allow you to save pre-tax dollars for medical expenses. Contributions, earnings, and withdrawals are all tax-free when used for qualified medical expenses.

Contribution Limits for 2024

- $3,850 for individuals

- $7,750 for families

Additional Tip

You can use HSA funds for a wide range of expenses, from prescription medications to eyeglasses.

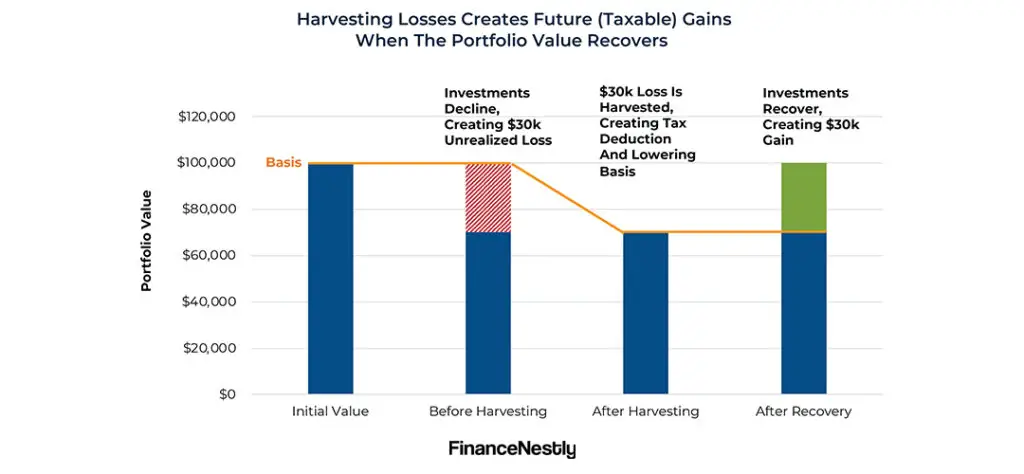

Harvest Investment Losses

What Is Tax-Loss Harvesting?

This strategy involves selling underperforming investments to offset capital gains and reduce your taxable income.

How It Works

- Match your losses against your gains to lower your overall tax liability.

- If losses exceed gains, you can deduct up to $3,000 against your ordinary income.

Pro Tip

Work with a financial advisor to ensure your investments align with your long-term goals while taking advantage of tax benefits.

Defer Income Where Possible

Why Defer?

Pushing income into the following year can help you stay in a lower tax bracket for the current year.

Examples

- Ask your employer to delay year-end bonuses.

- Postpone invoicing clients until January if you’re self-employed.

Conclusion: Plan Ahead to Reduce Your Tax Bill

Reducing your tax bill requires proactive planning and a thorough understanding of available deductions, credits, and financial strategies. By implementing these tips, you can minimize your tax liability and maximize your savings for 2024.

Consider working with a tax professional to ensure you’re taking full advantage of every opportunity to lower your taxes.