Introduction: A Dynamic Market Landscape

Currency markets, or forex, are among the most sensitive to global economic events. From geopolitical tensions to central bank decisions, these markets respond in real-time, reflecting the pulse of the global economy. Investors, policymakers, and businesses alike must understand the factors driving these fluctuations to navigate the complexities of international trade and finance.

This blog explores how global economic events impact currency markets, the mechanisms behind these shifts, and what they mean for stakeholders worldwide.

How Economic Events Influence Currency Markets

Monetary Policy Decisions

Central banks, such as the Federal Reserve or the European Central Bank, influence currency values through interest rate adjustments and quantitative easing or tightening measures. A rise in interest rates typically strengthens a currency by attracting foreign investment, while rate cuts can weaken it.

Economic Data Releases

Key economic indicators, such as GDP growth, unemployment rates, and inflation figures, can cause significant movements in currency values. Positive data often boosts investor confidence, leading to currency appreciation, while negative data has the opposite effect.

Geopolitical Events

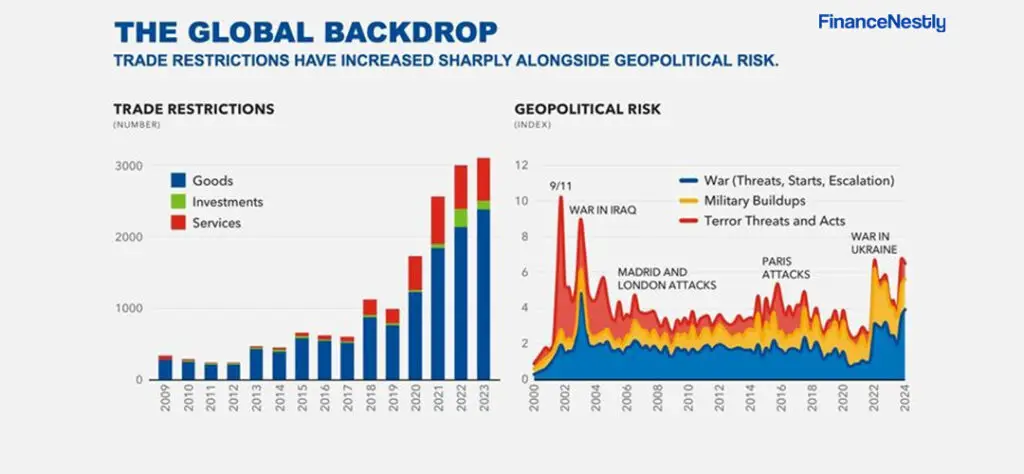

Geopolitical stability or turmoil directly impacts currency markets. Events such as elections, trade wars, or military conflicts can either strengthen or destabilize currencies depending on their perceived risk or opportunity.

Key Global Events Shaping Currency Markets

1. Trade Agreements and Disputes

Trade agreements can bolster the value of currencies by fostering economic cooperation and growth. Conversely, trade disputes and tariffs can lead to uncertainty and currency devaluation.

2. Natural Disasters and Pandemics

Events like the COVID-19 pandemic have profound effects on currency markets. The initial uncertainty caused capital flight to safe-haven currencies like the US dollar, while long-term effects varied depending on recovery strategies.

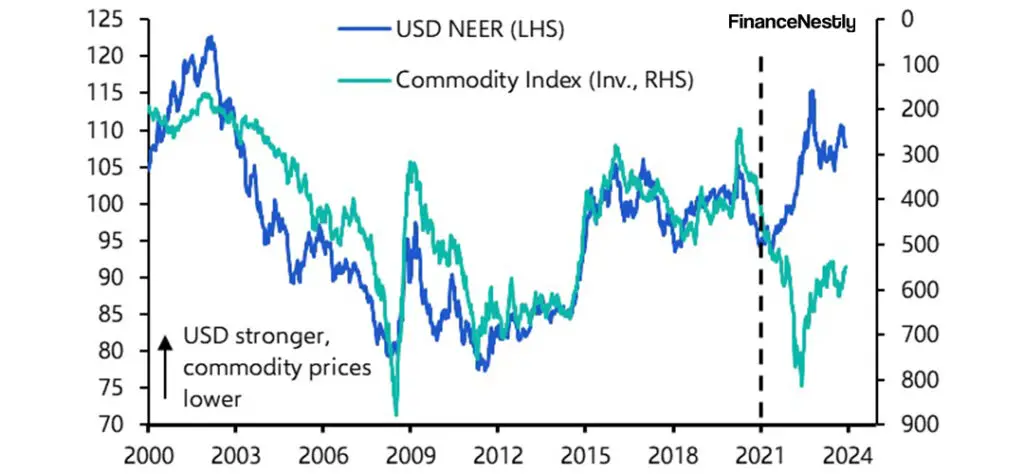

3. Commodity Price Shocks

For commodity-exporting countries, fluctuations in prices for goods like oil, gold, or natural gas can have a direct impact on their currencies. For example, a sharp decline in oil prices often weakens currencies like the Russian ruble or the Canadian dollar.

Opportunities and Risks in Currency Markets

Opportunities

- Diversification: Forex markets offer a range of currencies and trading pairs to hedge against risk.

- High Liquidity: With trillions of dollars traded daily, forex markets provide unmatched liquidity.

- Leverage: Many forex platforms offer leverage, allowing traders to amplify their investments.

Risks

- Volatility: Currency markets can experience sharp and unpredictable swings.

- Leverage Risks: While leverage increases profit potential, it also magnifies losses.

- Geopolitical Sensitivity: Unexpected events can rapidly alter market dynamics, leading to significant losses.

Strategies for Navigating Currency Markets

1. Stay Informed

Understanding the impact of global events on forex markets requires staying updated on economic data, central bank announcements, and geopolitical developments.

2. Utilize Risk Management Tools

Stop-loss orders, position sizing, and portfolio diversification can help mitigate risks associated with currency trading.

3. Adopt a Long-Term Perspective

While short-term trading can be lucrative, a long-term perspective based on economic fundamentals often yields more stable returns.

Conclusion: Understanding the Ripple Effect

Global economic events have far-reaching impacts on currency markets, creating both challenges and opportunities for traders and investors. By comprehending the mechanisms driving currency fluctuations, stakeholders can make informed decisions to navigate this volatile yet rewarding landscape. As the world becomes increasingly interconnected, the influence of global events on forex markets will only grow, emphasizing the need for vigilance and adaptability.