Fixed income investments are an essential component of a balanced investment portfolio. These financial instruments, such as bonds and certificates of deposit (CDs), provide investors with regular income, often in the form of interest payments. For those seeking to build a stable portfolio or reduce risk, understanding the fundamentals of fixed income is key. In this guide, we’ll explore what fixed income investments are, how they work, the different types available, and why they might be right for your investment strategy in 2024.

What is Fixed Income?

At its core, fixed income refers to any type of investment that offers regular, set returns on a predetermined schedule. Unlike stocks, which offer potentially higher returns but also come with greater risk, fixed income investments typically offer lower returns with reduced risk. Common examples include government bonds, municipal bonds, and corporate bonds, all of which pay interest to investors over a fixed period.

One of the primary benefits of fixed income investments is their reliability. Investors can predict their returns with a high degree of certainty, which is ideal for those who prefer a more conservative approach to investing. Moreover, these assets can provide a steady cash flow, which is particularly attractive for retirees or those looking to reduce portfolio volatility.

Types of Fixed Income Investments

There are several types of fixed income investments, each offering different risk profiles and returns. The most common are:

- Government Bonds: Issued by national governments, these bonds are considered low-risk investments. U.S. Treasury bonds, for instance, are among the safest investment options, backed by the full faith and credit of the U.S. government. While they offer lower yields compared to corporate bonds, their security is unmatched.

- Municipal Bonds: These are issued by state and local governments and are often used to fund public projects. The key advantage of municipal bonds is that the interest income is typically exempt from federal taxes, and in some cases, state and local taxes as well.

- Corporate Bonds: Issued by companies to raise capital, corporate bonds offer higher yields than government or municipal bonds. However, they come with higher risk, especially when issued by companies with lower credit ratings. Corporate bonds can be an excellent way to diversify your fixed income portfolio and take advantage of higher returns, but they require careful analysis of the company’s financial health.

How Fixed Income Fits into Your Portfolio

Incorporating fixed income into your investment portfolio can provide stability, diversification, and reliable income streams. A well-structured portfolio typically balances equities (stocks) and fixed income investments to manage risk and achieve long-term growth. The proportion of fixed income investments you should hold depends on your risk tolerance, time horizon, and investment goals.

For conservative investors or those nearing retirement, a larger allocation to fixed income might be advisable to preserve capital and ensure a steady income. On the other hand, younger investors with a longer time horizon might prefer a more aggressive allocation toward equities, while still holding some fixed income for diversification.

Risks and Considerations in Fixed Income Investing

While fixed income investments offer many benefits, they are not without risks. Interest rate risk is a primary concern: when interest rates rise, the value of existing bonds typically declines. This is because new bonds are issued at higher rates, making older bonds with lower interest rates less attractive to investors. Inflation risk is another factor to consider, as the returns from fixed income investments may not keep pace with rising living costs.

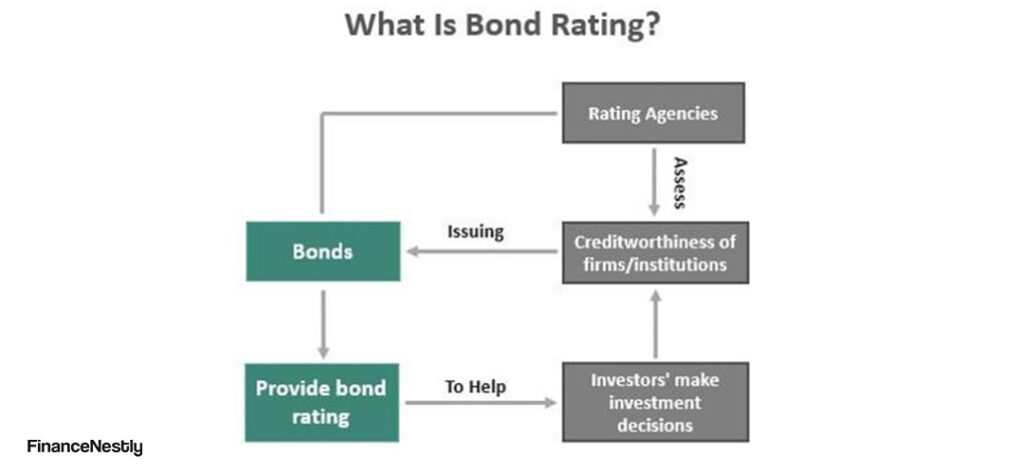

Moreover, credit risk can affect certain types of bonds, especially corporate bonds. If a company defaults on its debt obligations, investors may lose some or all of their investment. This makes it essential to research the creditworthiness of the issuing entity before investing.

How to Get Started with Fixed Income Investments

If you’re new to fixed income investing, the first step is to assess your financial goals and risk tolerance. Are you seeking steady income, or are you willing to accept more risk for higher returns? Understanding your investment objectives will help guide your choices.

Once you’ve identified your goals, consider diversifying your fixed income investments across different types of bonds and issuers. This strategy can help mitigate risks and ensure a more stable overall return. Additionally, make sure to monitor interest rates and economic conditions, as these factors can have a significant impact on the performance of your fixed income investments.

For a deeper understanding of how to analyze and select fixed income investments, refer to our in-depth guide on bond selection and risk management strategies.

Conclusion

Fixed income investments are an essential tool in the portfolio of any investor looking for stability, predictable returns, and diversification. By understanding the types of fixed income assets available, their benefits, and potential risks, you can make informed decisions that align with your financial goals. As with any investment strategy, it’s important to balance risk and reward and remain informed about the changing economic landscape.