Investing is one of the best ways to build wealth, but finding the right deals can be challenging, especially in a constantly evolving market. As 2024 progresses, it’s crucial to adapt your strategies to the current economic climate. Whether you’re interested in stocks, real estate, or alternative investments like cryptocurrency, knowing how to identify the best opportunities can make all the difference in your portfolio’s growth. This guide will walk you through the key steps to finding the best investment deals in 2024, offering tips on risk management, diversification, and evaluating potential returns.

1. Understand the Current Market Trends

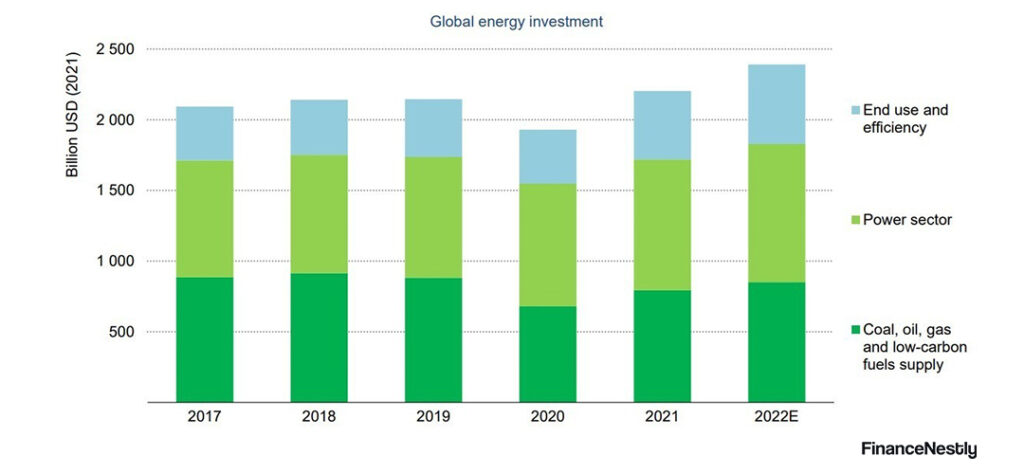

The first step in identifying great investment deals is to understand the prevailing market trends. In 2024, several factors are influencing the investment landscape, including the post-pandemic recovery, inflation rates, and shifts in global supply chains. Many investors are focusing on sectors like technology, renewable energy, and healthcare, all of which are experiencing significant growth.

To spot the best investment deals, keep an eye on:

- Economic Indicators: Watch for key data points such as interest rates, GDP growth, and inflation. These can guide your decisions about which sectors are likely to perform well.

- Emerging Markets: As global economies recover, emerging markets may present lucrative opportunities. Countries in Asia and Africa, for example, are seeing increasing foreign investment, which can be beneficial for investors looking to diversify.

2. Diversify Your Portfolio for Long-Term Success

One of the most important strategies for identifying great investment opportunities is diversification. While it might be tempting to focus solely on high-growth stocks or sectors, spreading your investments across different asset classes can reduce risk and increase your chances of finding profitable deals. Diversifying not only involves stocks and bonds but also considers alternative investments like real estate, commodities, and even cryptocurrencies.

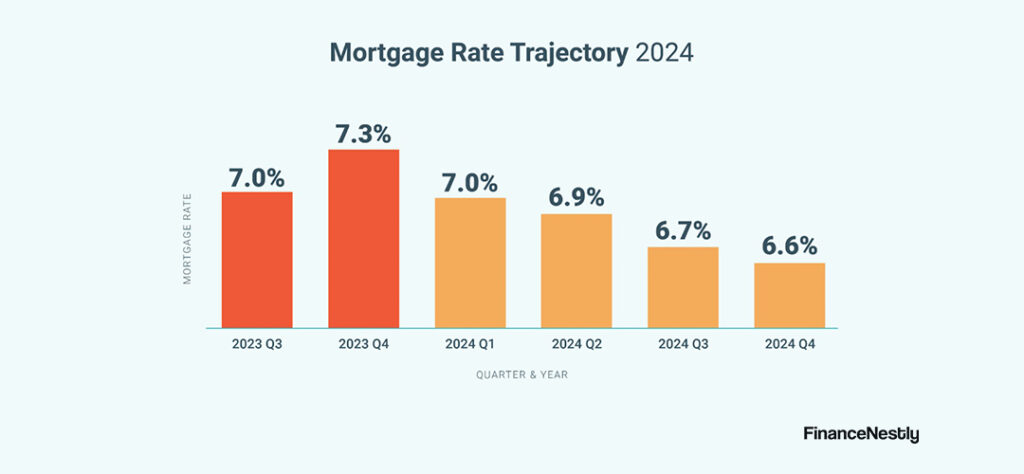

- Risk vs. Reward: Different investments come with different levels of risk. For instance, tech stocks might offer high growth potential but can be volatile. Meanwhile, real estate tends to be more stable, though it requires more capital.

- Portfolio Balancing: A well-balanced portfolio may include a mix of equities, fixed-income securities, and tangible assets. Consider adding real estate investment trusts (REITs) or low-cost index funds to help cushion against market fluctuations.

For more on diversification, check out this guide on building a diversified portfolio.

3. Evaluate Risk and Return

Every investment comes with its own risk, but the key is to evaluate whether the potential returns justify that risk. In 2024, markets are expected to continue to show volatility, and identifying investments with favorable risk-to-reward ratios is essential.

To evaluate potential returns:

- Look at Historical Data: Examine how a particular investment has performed over time. This will give you an idea of its risk profile and potential for future gains.

- Consider Future Trends: Think about upcoming trends, like the rise of sustainable investing or the boom in electric vehicles. Investments aligned with future growth prospects are more likely to deliver higher returns.

A good place to start is by reading up on some current high-return investment sectors, such as tech, green energy, and biotech. Many experts predict that these sectors will continue to offer great opportunities.

4. Use Investment Platforms and Tools

In 2024, the digital transformation has significantly impacted how investors access and manage their portfolios. Online platforms like brokerage accounts, robo-advisors, and real estate platforms offer easy access to a wide variety of investment deals. Additionally, many of these platforms provide tools to evaluate risk, track market trends, and even automate trading.

- Brokerage Accounts: Online brokerage accounts like Robinhood, E*TRADE, and Charles Schwab give you access to a range of stocks, ETFs, and bonds with low fees and easy-to-use interfaces.

- Robo-Advisors: Services like Betterment and Wealthfront automate investment decisions based on your risk tolerance and goals, making them great for beginners.

- Real Estate Platforms: Websites like Fundrise allow you to invest in real estate with as little as $500, providing opportunities that were previously available only to accredited investors.

For more on using robo-advisors, take a look at this comparison of popular robo-advisors.

5. Assess the Track Record and Reputation of Investment Opportunities

When evaluating potential investment deals, always consider the track record and reputation of the companies or platforms involved. While past performance is not always indicative of future results, a solid track record can give you confidence in the investment’s potential.

- Check for Transparency: Look for companies or funds that are transparent about their investment strategies and financial health. A good sign is if they publish regular reports and hold themselves accountable.

- Research the Management Team: Strong leadership often results in better management of investments. Look into the qualifications and history of the people managing the assets you are interested in.

If you are considering an investment in a new startup or a tech company, do thorough research on its leadership and market potential. Platforms like Crunchbase can provide valuable insight into the backgrounds of these companies.

Conclusion

Identifying the best investment deals in 2024 involves staying informed about market trends, diversifying your portfolio, evaluating risk versus reward, using the right platforms, and researching the companies behind the deals. While there is no one-size-fits-all approach to investing, a combination of these strategies will increase your chances of finding opportunities that align with your financial goals. The key is to stay proactive, educated, and adaptable in a rapidly changing market.