Investing in foreign currencies, or forex trading, can seem intimidating for beginners. However, with the right approach, it can be a profitable avenue for diversification and gaining exposure to global markets. In this guide, we’ll cover the essentials of how to get started with currency investment, tips for minimizing risks, and how to make informed decisions to grow your portfolio.

1. Understand the Basics of Forex Trading

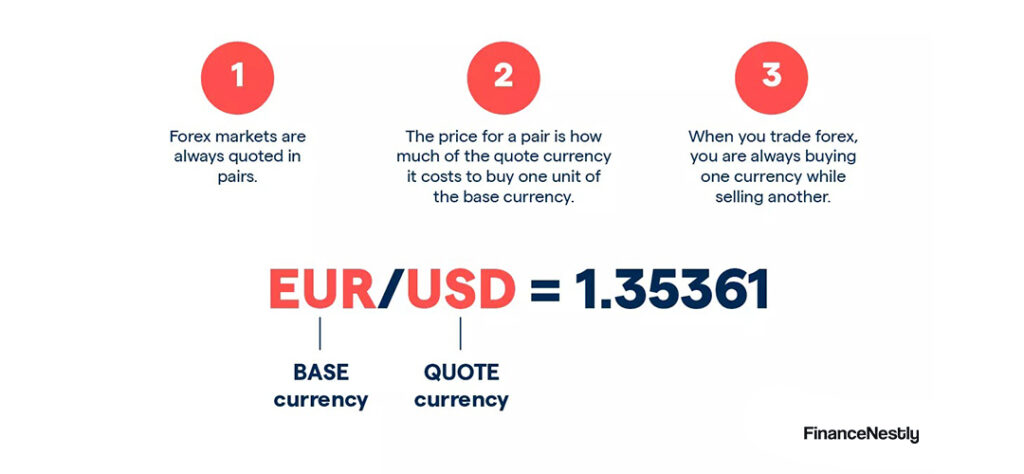

Forex trading involves the exchange of one currency for another, typically in currency pairs like EUR/USD (Euro/US Dollar). The aim is to buy a currency at a low price and sell it at a higher price, making a profit. Unlike stock trading, the forex market operates 24 hours a day, five days a week, making it accessible to traders across different time zones.

There are a few key concepts to understand:

- Currency Pairs: In forex, currencies are quoted in pairs, with the first currency being the base currency and the second being the quote currency. For example, in EUR/USD, EUR is the base and USD is the quote currency.

- Exchange Rate: This is the rate at which one currency can be exchanged for another. Currency prices are influenced by global economic factors like interest rates, inflation, and political events.

- Leverage: Forex trading allows traders to control a large position with a smaller initial investment through leverage. While this can amplify profits, it also increases risk.

Before diving into the market, it’s important to familiarize yourself with these terms. For more in-depth information, check out this Forex glossary.

2. Choose a Reliable Forex Broker

To begin trading foreign currencies, you’ll need to choose a broker that will facilitate your trades. Not all brokers are created equal, so it’s important to pick one that meets your needs:

- Regulation: Ensure the broker is regulated by a reputable financial authority (such as the U.S. Commodity Futures Trading Commission or the UK’s Financial Conduct Authority) to protect your investment.

- Trading Platform: Brokers offer different platforms for executing trades. Popular ones include MetaTrader 4 and 5, which provide tools for analysis and automated trading.

- Fees and Spreads: Forex brokers earn by charging a spread—the difference between the buy and sell price. Compare the spreads of different brokers to find one with the most competitive pricing.

Many brokers offer demo accounts where you can practice without risking real money. If you’re just starting, it’s a good idea to test out a few platforms before committing your funds.

3. Learn Technical and Fundamental Analysis

To make informed decisions in forex trading, it’s crucial to understand the two main types of analysis: technical and fundamental.

- Technical Analysis: This method involves analyzing price charts and historical data to forecast future currency movements. Traders often use indicators such as Moving Averages, Bollinger Bands, and the Relative Strength Index (RSI) to identify trends and entry points.

- Fundamental Analysis: This involves looking at the broader economic factors that influence currency values. This can include interest rates, inflation data, GDP growth, and political events. For example, a country with rising interest rates often sees an increase in the value of its currency.

Both types of analysis are important and can be used in combination to develop a trading strategy. You can dive deeper into these topics through resources like this technical analysis guide.

4. Start Small and Build Experience

One of the most important rules of forex trading is to start small. As a beginner, don’t risk too much capital early on. Even with the potential for large gains through leverage, it’s vital to minimize risk until you understand how the market works.

- Demo Accounts: Most brokers offer demo accounts, where you can practice with virtual money. This is a great way to get a feel for the platform and market without putting your own funds at risk.

- Risk Management: Never risk more than you can afford to lose. Use tools like stop-loss orders, which automatically sell a currency pair if it hits a certain price, to protect your investments.

- Gradual Growth: Once you gain more experience, you can increase your trading size and experiment with more advanced strategies.

The key to success in forex trading is consistency and learning from mistakes. Invest time in building a solid understanding before going after larger gains.

5. Stay Updated and Continue Learning

The forex market is affected by global events and economic news. Staying updated on news that affects currency prices is essential for making informed decisions. Key events include:

- Economic Data Releases: Data such as unemployment figures, GDP reports, and inflation can significantly influence the strength of a currency.

- Central Bank Announcements: Decisions by central banks regarding interest rates can have a major impact on currency values.

- Geopolitical Events: Political instability, wars, or elections can cause volatility in the forex market.

Join online forums or follow news outlets like Bloomberg or CNBC to stay updated. You can also check out this beginner’s guide to forex news.

Conclusion

Investing in foreign currencies can be a rewarding but complex venture. By understanding the fundamentals of forex trading, choosing the right broker, and practicing sound risk management, you can begin your journey into the world of currency investment with confidence. Remember, like any form of trading, success in forex requires patience, continuous learning, and adaptability to market conditions.