In 2024, securing a personal loan with favorable rates is an essential step towards achieving your financial goals, whether you’re consolidating debt, funding a large purchase, or covering unexpected expenses. With interest rates fluctuating and lending policies evolving, knowing how to navigate the process can help you save money and get the best deal possible. In this blog post, we’ll explore strategies to secure the best personal loan rates, helping you make informed decisions when borrowing money.

1. Understand Your Credit Score and Improve It

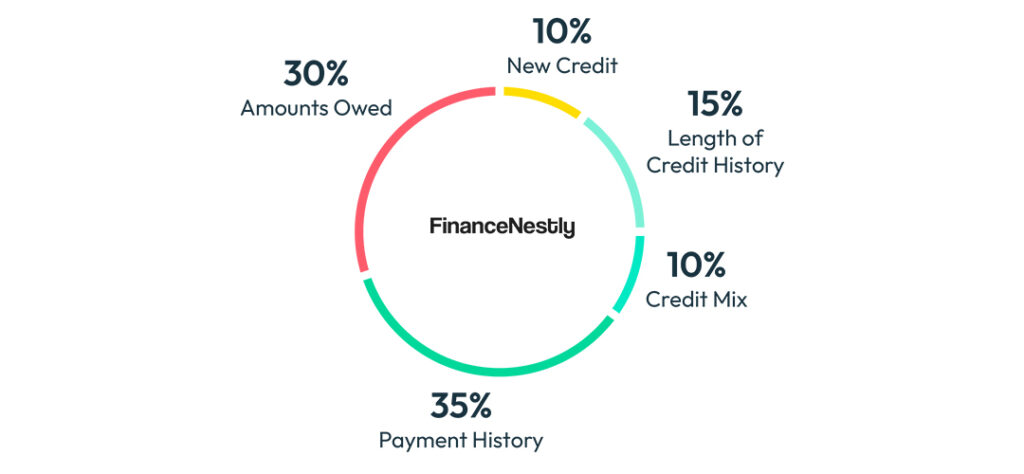

One of the most significant factors in determining your personal loan rate is your credit score. Lenders view borrowers with higher credit scores as less risky, which often results in lower interest rates. In 2024, maintaining a good credit score is crucial to getting the best rates on personal loans. A credit score of 700 or above is typically considered good, while a score of 750 or higher will often qualify you for the most competitive rates.

Before applying for a personal loan, take a few steps to improve your credit score if necessary. Paying down outstanding debt, ensuring your credit report is error-free, and avoiding new credit inquiries can help boost your score in a relatively short period. Tools like this credit score checker can help you monitor your score and identify areas for improvement.

Additionally, paying bills on time and reducing credit card balances can have a noticeable impact. Lenders will often offer better terms to borrowers who demonstrate good financial responsibility.

2. Shop Around for the Best Lender

Not all lenders offer the same interest rates or loan terms, so it’s essential to shop around and compare offers. In 2024, personal loans are available through banks, credit unions, online lenders, and peer-to-peer lending platforms. Each of these lenders has different eligibility criteria, interest rates, and loan structures, so taking the time to compare them will help you secure the best deal.

Consider using online comparison tools to quickly view loan options from multiple lenders. Websites like LendingTree and NerdWallet provide personalized loan comparisons, allowing you to compare rates, terms, and fees.

When evaluating loan offers, don’t just look at the interest rate. Consider the APR (annual percentage rate), which includes both the interest rate and any fees associated with the loan. A low-interest rate can be offset by high fees, so it’s essential to evaluate the total cost of the loan.

3. Opt for a Shorter Loan Term

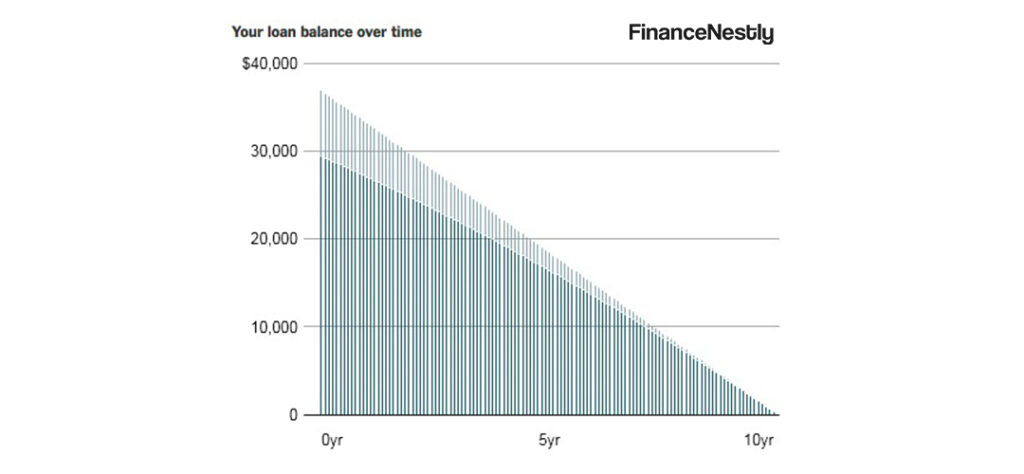

While longer loan terms may seem appealing because of the lower monthly payments, they often come with higher overall interest rates. In 2024, if you can afford higher monthly payments, choosing a shorter loan term can save you money in the long run by lowering the total interest you pay.

For example, a 3-year personal loan may have a higher monthly payment than a 5-year loan, but the interest rate on the 3-year loan is often lower. This means that while your payments may be higher, you’ll pay less in interest over the life of the loan.

Be sure to calculate the total cost of the loan using different term lengths before making a final decision. Tools like this loan calculator can help you compare different term lengths and determine the best option for your budget and financial goals.

4. Consider Secured Loans for Better Rates

Secured loans, where you offer collateral (such as a car or savings account), can provide more favorable terms compared to unsecured loans. By securing the loan with an asset, you reduce the lender’s risk, which often results in a lower interest rate.

If you own a car or have significant savings, consider applying for a secured personal loan to lock in a lower rate. However, be aware that this option comes with the risk of losing the collateral if you fail to repay the loan.

If you choose a secured loan, make sure to carefully assess your ability to repay the loan on time to avoid jeopardizing your assets. For more information on the pros and cons of secured versus unsecured loans, check out this detailed guide.

5. Improve Your Debt-to-Income Ratio

Your debt-to-income (DTI) ratio is another factor that lenders consider when determining your personal loan rate. This ratio compares your monthly debt payments to your gross monthly income. A lower DTI ratio is seen as favorable because it indicates that you are less likely to default on the loan.

In 2024, many lenders look for a DTI ratio below 40%, although some may accept higher ratios with compensating factors, such as a strong credit score or a high income. If your DTI ratio is high, consider paying down some existing debt before applying for a personal loan to improve your chances of getting a better rate.

6. Time Your Application Wisely

The timing of your loan application can also affect the interest rate you receive. Rates tend to fluctuate based on economic conditions, so it’s important to stay informed about the state of the economy and interest rate trends. In 2024, interest rates may vary depending on inflation, Federal Reserve policies, and market conditions.

Keep an eye on interest rate forecasts and try to apply for a personal loan when rates are lower. You can stay updated on interest rate trends by visiting trusted financial news websites like The Wall Street Journal.

Conclusion

Securing the best personal loan rates in 2024 requires a strategic approach. By understanding your credit score, shopping around for the best lender, opting for a shorter loan term, and considering secured loan options, you can significantly reduce the amount you pay in interest. Additionally, improving your debt-to-income ratio and timing your application will increase your chances of receiving competitive rates. Take the time to evaluate your options and choose a loan that fits your financial situation, ensuring that you get the best deal possible.