1. Understand Your Healthcare Needs

Before diving into the details of different health insurance plans, it’s essential to assess your personal healthcare needs. Are you generally healthy and only need preventive care, or do you have chronic conditions that require ongoing treatment? Knowing your health needs will help you choose a plan that best matches your lifestyle and minimizes your out-of-pocket costs.

For individuals with pre-existing conditions or ongoing treatments, comprehensive coverage with a wider network of specialists might be crucial. On the other hand, if you’re healthy and rarely need medical care, a plan with a higher deductible and lower monthly premiums could be more cost-effective. It’s important to ask yourself questions such as:

- How often do I visit the doctor or need prescriptions?

- Do I need specialized treatments or medications?

- Will I need surgery or emergency care in the near future?

2. Compare Health Insurance Plan Types

There are several types of health insurance plans available, each with its own pros and cons. Understanding these plan types will allow you to determine which one fits your needs the best. Here’s a breakdown of the most common options:

- Health Maintenance Organization (HMO): HMO plans typically offer lower premiums but require you to choose a primary care physician (PCP) and get referrals for specialist care. While these plans may limit your healthcare provider choices, they are often ideal for those who want an affordable, straightforward plan.

- Preferred Provider Organization (PPO): PPO plans offer more flexibility, allowing you to visit any doctor or specialist without a referral, though this flexibility comes at a higher price. PPO plans are ideal for individuals who prioritize choice and convenience.

- Exclusive Provider Organization (EPO): EPO plans combine aspects of both HMO and PPO plans. They require you to use a network of doctors, but you don’t need a referral to see specialists. They often come at a moderate price, making them a good option for those seeking a balance between flexibility and cost.

- Point of Service (POS): POS plans also require you to choose a PCP, but they provide more flexibility for seeing specialists, though you’ll pay more for out-of-network care.

When comparing these plans, consider your lifestyle and how much you’re willing to spend for flexibility and convenience. For more information on the pros and cons of each plan type, visit this article comparing different health insurance plans.

3. Analyze Costs Beyond Premiums

While monthly premiums are an essential factor to consider, they are not the only costs associated with a health insurance plan. You’ll also need to factor in your deductible, copayments, and coinsurance.

- Deductible: This is the amount you must pay out-of-pocket before your insurance begins to cover costs. A plan with a lower premium might have a higher deductible, so it’s crucial to balance these two factors based on your expected medical expenses.

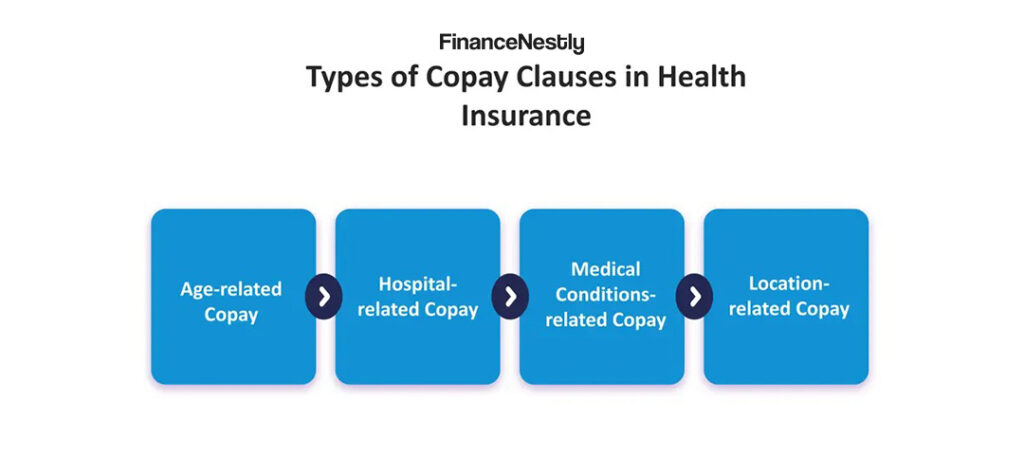

- Copayments and Coinsurance: These are the fees you pay when you visit a doctor or receive medical services. Some plans have lower copayments or coinsurance for primary care visits, but higher costs for specialists or emergency care. Look for a plan that offers the best balance of affordable copays and coinsurance for the services you use most frequently.

4. Check the Network of Healthcare Providers

One of the most important factors when selecting a health insurance plan is the network of healthcare providers available to you. A plan with a broad network of doctors, hospitals, and specialists will give you more choices, but plans with narrow networks may offer lower premiums.

If you have preferred healthcare providers or specialists, ensure they are included in the plan’s network. Many insurers allow you to check the network online or offer customer service support to answer your questions. Keep in mind that out-of-network care often comes with higher out-of-pocket costs, so verify the plan’s network before making your decision.

5. Consider Additional Benefits and Coverage

In 2024, many health insurance plans offer additional benefits beyond the basics. Some plans include mental health coverage, dental and vision care, wellness programs, and even telemedicine services. If these services are important to you, be sure to factor them into your decision.

Furthermore, some plans offer coverage for alternative therapies, like chiropractic or acupuncture, which may be worth considering if you have specific healthcare needs. Additional benefits can make a significant difference in your overall satisfaction with a plan, so be sure to evaluate them carefully.

6. Review the Plan’s Reputation and Customer Service

Lastly, it’s important to evaluate the reputation of the insurer. Research customer reviews and check for complaints related to claims processing, customer service, and billing practices. An insurance plan might offer excellent benefits, but poor customer service can make dealing with claims and reimbursements frustrating. Look for insurers with strong ratings from independent agencies, such as J.D. Power or the National Committee for Quality Assurance (NCQA), to ensure you’re making a well-informed decision.

Conclusion

Choosing the best health insurance plan in 2024 involves careful consideration of your healthcare needs, budget, and preferences. By evaluating your options based on the plan type, costs, provider network, and additional benefits, you can make a choice that aligns with your lifestyle. With so many options available, taking the time to compare plans will help ensure you get the best value for your healthcare coverage.