The car insurance industry is undergoing a transformative shift, driven by advancements in technology. From personalized pricing models to AI-powered claims processing, technology is reshaping how insurance companies operate and how consumers interact with them. In this blog, we’ll explore the key innovations revolutionizing car insurance and what they mean for drivers and insurers alike.

1. Usage-Based Insurance and Telematics

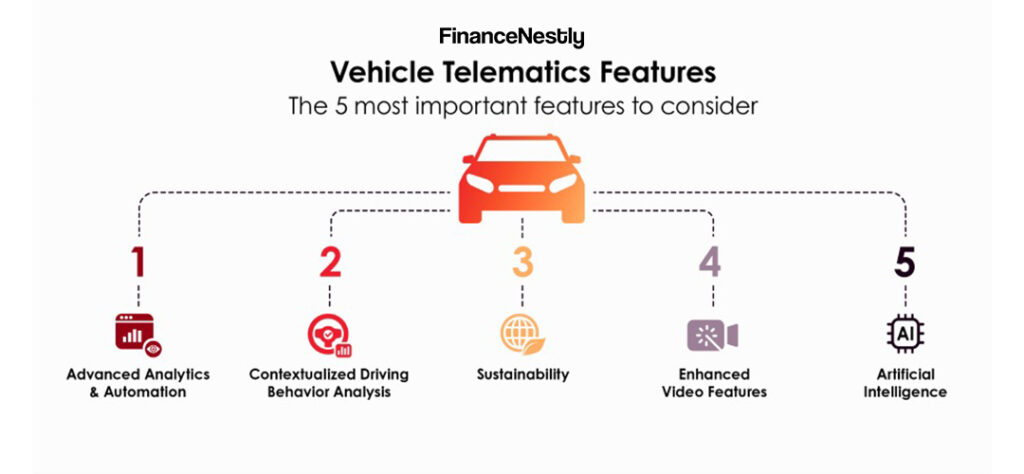

One of the most impactful innovations in car insurance is the rise of usage-based insurance (UBI) powered by telematics. By using devices or apps to track driving behavior, insurers can assess factors like speed, braking habits, and mileage to offer tailored premiums. This approach benefits safe drivers with lower rates while encouraging responsible driving habits across the board.

Telematics is particularly useful for fleet management and young drivers, providing transparency and accountability. As this technology continues to evolve, its adoption is expected to grow rapidly.

2. AI-Powered Claims Processing

Artificial intelligence (AI) is transforming claims processing, making it faster, more accurate, and efficient. AI systems can analyze accident images, assess damages, and even determine repair costs in a matter of minutes. This reduces the claims cycle time and improves customer satisfaction.

Insurers are also leveraging AI for fraud detection, identifying suspicious patterns and reducing fraudulent claims. For example, AI algorithms can flag inconsistencies in accident reports, saving insurers billions of dollars annually.

If you’re curious about AI’s broader impact on the insurance industry, check out this comprehensive guide on AI applications in insurance.

3. Blockchain and Smart Contracts in Insurance

Blockchain technology is introducing transparency and trust into car insurance processes. Smart contracts enable automatic claims execution once predefined conditions are met, eliminating delays and disputes. This is particularly beneficial for parametric insurance models, where claims are triggered by specific events like weather conditions.

Additionally, blockchain enhances data security, ensuring sensitive customer information is protected. As the technology becomes more mainstream, its potential to revolutionize policy issuance and claims management will become increasingly apparent.

4. The Role of Connected Cars and IoT

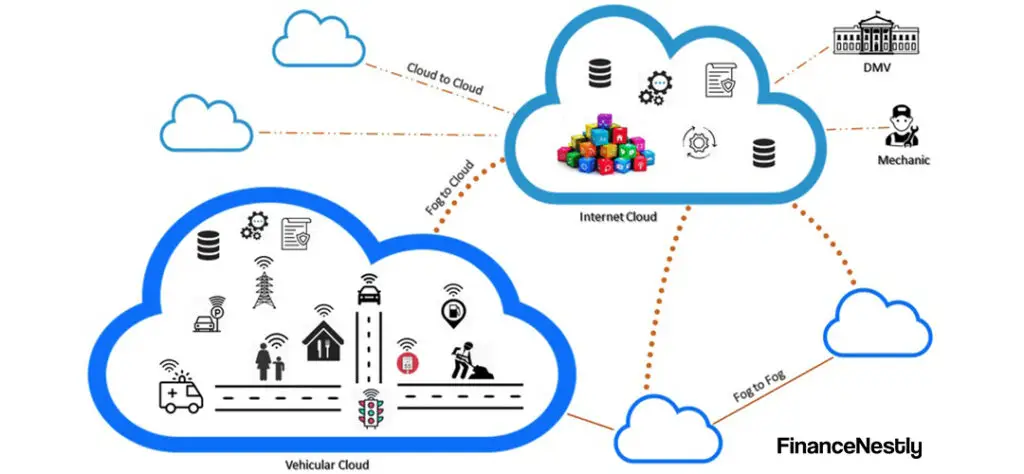

Connected cars equipped with Internet of Things (IoT) devices are playing a crucial role in the evolution of car insurance. These vehicles can monitor and share data on driving habits, vehicle performance, and even real-time location.

This wealth of data allows insurers to provide hyper-personalized policies that adjust based on individual driving behaviors. Furthermore, IoT devices can assist in accident reconstruction, providing precise details about events leading up to a collision.

5. Challenges and Ethical Considerations

While technology offers numerous benefits, it also presents challenges. Data privacy is a major concern, as telematics and IoT devices collect vast amounts of personal information. Insurers must ensure compliance with data protection regulations and maintain customer trust.

Another challenge is the potential for algorithmic bias in AI systems, which could lead to unfair policy pricing or claims denial. It’s critical for insurers to prioritize transparency and ethical AI development.

For a deeper understanding of ethical AI practices, consider exploring this guide to responsible AI implementation.

6. Looking Ahead: The Future of Car Insurance

The car insurance industry is poised for continued evolution. With autonomous vehicles on the horizon, insurers will need to adapt their policies to account for shared liability between drivers and vehicle manufacturers. Moreover, advancements in AI and IoT will further refine pricing models, claims processes, and customer experiences.

Ultimately, technology is not just changing car insurance—it’s setting the stage for a safer, more efficient, and customer-centric industry.

Conclusion

From usage-based insurance to blockchain and connected cars, technology is reshaping the car insurance landscape. While challenges remain, the potential for innovation and improved customer experiences is immense. For both drivers and insurers, the future of car insurance promises to be dynamic and transformative.